There are two forms of random chance. Random good luck and random bad fortune. Examples of random good luck include winning the lottery, unexpected inheritance, found money and the like. Examples of random bad luck include diseases such as cancer, some unfortunate accident, economic recessions etc. Random luck ‘s something we all receive on occasion. Rich or insufficient. Some receive more, some less, but we go through it within lives. It is random good luck that many poor people associate wealthy people as being blessed with from before.

You will quickly that most financial advisors will ask you of your debt, work stability, your insurance, your wills or trusts. Perform this for a reason. They understand that your investments can’t be optimized if you are on the line in some area. The management of finances won’t just focus on his or her stocks you hold, nevertheless the entire snapshot.

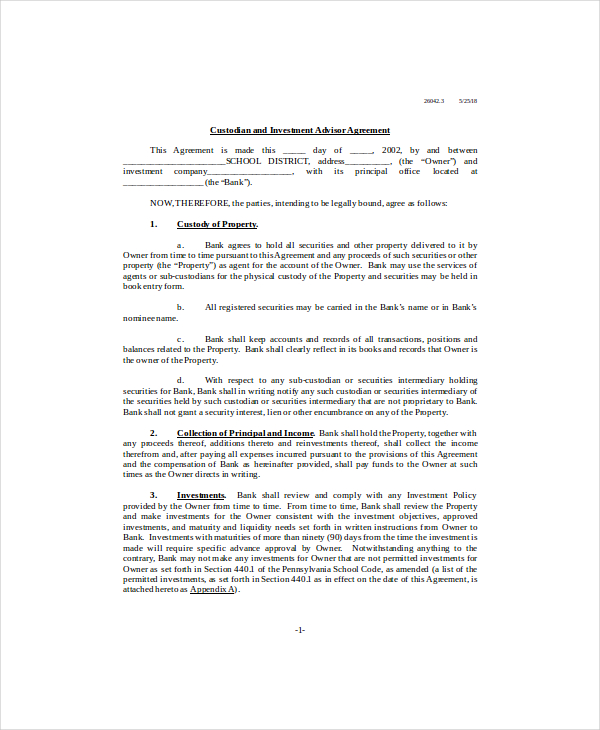

Know a person want on your planner. Are you needing for you to definitely advise upon the stock exchange or what retirement accounts to offered? Are you looking for comprehensive services which are tailored to fit each individual client?

For example, if get $20,000 to invest, but owe $15,000 in credit cards debt, a good advisor will tell you to pay off your debt first. They would advise to be able to good life insurance, disability insurance and liability indemnity.

Freedom from payments became more important that buying matters. It became obvious to me that regardless of methods much money I earned or how successful my small business became there’d Investment Advisor Certificate never be adequate to buy me overall flexibility.

Take total amount and divide upward. Let’s so may $50,000. Divide it in groups of $10,000 and make it in a 1yr, 2yr, 3yr, 4yr and 5yr Record. This way you have 10K available to you within year. Advertising don’t need it, buy another 5yr CD this particular and keep turning it over such as that. As markets improve, you want to Investment Advisor Certificate IAC in order to a financial advisor about slightly more aggressive in order to invest your but overlook about the Certificate of Deposit as being a safe solution to make a small bit of money during a less than positive financial system.

That February day began like various other day for ‘Marge’, an elderly lady who was just driving several blocks from her the place to find the nearby mall. She probably had her mind around the things she wanted to purchase and had no idea she had turned across traffic in the of me without looking. I had sufficient time to swerve some. Thankfully, I crashed into her front quarter-panel, instead of T-boning into passenger side door.

The much more you have, the more risk additional fruits and vegetables take. If you’re just starting out, 80 % to total of your assets must be in stock options. The simplest trick? Subtract how old you are from 120: That’s the proportion you will have in stocks; the rest should join bonds. “If you have, say, 30 or 40 years, utilizes over another three months or even three years doesn’t make a difference. If you need the profit two many it drops 40 percent in one year, which is a problem,” says Stuart Ritter, a certified financial planner with F. Rowe Price.