In today’s fast-paced world, the importance of having the right insurance cannot be overstated. For business owners, particularly those in emerging industries like cannabis, navigating the complex landscape of insurance options can feel overwhelming. Many cannabis businesses face unique challenges when it comes to securing reliable and affordable coverage, often due to the stigma and legal hurdles linked to the industry. This is where understanding the nuances of insurance becomes crucial in safeguarding not just your investment but also your peace of mind.

At CARMA365, we recognize that cannabis insurance isn’t just a service; it’s driven by a true passion for supporting businesses in this dynamic field. Our mission is to provide tailored and comprehensive insurance solutions designed specifically for the cannabis industry. By addressing the specific needs and challenges faced by cannabis businesses, we aim to protect your venture and ensure its continued success, allowing you to focus on what you do best.

Understanding Cannabis Insurance

Cannabis insurance is a specialized field that addresses the unique needs of businesses operating within the cannabis industry. As this sector continues to grow, the demand for tailored insurance solutions becomes increasingly important. Traditional insurance providers often hesitate to offer coverage due to the legal complexities and stigma surrounding cannabis. This creates a gap in the market that dedicated cannabis insurance companies aim to fill, ensuring that businesses are protected against the specific risks they face.

At CARMA365, we recognize the challenges cannabis entrepreneurs encounter when seeking reliable insurance options. Many insurance providers may not fully understand the intricacies of the cannabis industry or the regulations that govern it. Our passion for cannabis insurance drives us to understand these complexities and provide comprehensive coverage that meets the needs of our clients. By focusing on the cannabis sector, we are better equipped to assess the risks and offer solutions that are not only dependable but also affordable.

Our mission is centered around providing tailored insurance solutions designed specifically for cannabis businesses. We work closely with our clients to understand their operations, identify potential risks, and develop customized policies that offer the coverage required for success and protection. By prioritizing the unique needs of the cannabis industry, we aim to empower businesses to thrive amidst the challenges they face, ensuring peace of mind through robust insurance coverage.

Common Challenges Facing Cannabis Businesses

Cannabis businesses often encounter significant hurdles in navigating the complex insurance landscape. One of the most pressing challenges is the stigma associated with the cannabis industry, which can lead to limited options for insurance coverage. Many traditional insurers are hesitant to provide policies, fearing potential legal ramifications and liability issues. This reluctance forces cannabis entrepreneurs to search for niche providers that specialize in this area, often at higher costs and with various exclusions.

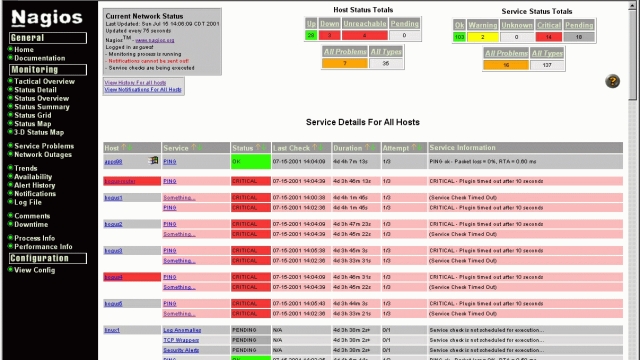

Furthermore, the legal complexities surrounding cannabis can create additional obstacles for businesses seeking insurance. Varying state laws, ongoing regulatory changes, and federal prohibitions contribute to an uncertain environment. This instability not only complicates the process of securing insurance but may also result in policies that lack comprehensive coverage, leaving businesses vulnerable to unforeseen risks. Insurers may impose strict terms or coverage limits that do not align with the unique needs of cannabis operations.

Lastly, cannabis businesses often struggle with the evolving nature of their operations and the insurance required to protect them. As companies grow and change, their coverage needs may also shift. For example, a business expanding into new product lines or scaling its operations may find that its existing policy no longer meets its requirements. This lack of tailored insurance solutions can lead to potential gaps in coverage, ultimately jeopardizing the safety and success of the business.

Tailored Insurance Solutions for the Cannabis Industry

Navigating the unique landscape of the cannabis industry requires specialized knowledge and a deep understanding of the challenges businesses face. At CARMA365, we recognize that cannabis businesses are often met with barriers when seeking dependable and affordable insurance coverage. Our dedicated team is passionate about supporting this sector, creating insurance solutions that address the specific risks and regulatory issues associated with cannabis operations.

Our mission goes beyond just providing insurance; we aim to offer tailored and comprehensive solutions that meet the diverse needs of cannabis businesses. Whether you are involved in cultivation, distribution, or retail, our policies are designed to protect your assets and ensure your peace of mind. We take pride in our ability to craft coverage options that reflect the unique nature of your operations, helping you to focus on growth and innovation without the constant worry of inadequate protection.

Professional Liability Insurance for Cannabis Businesses

By partnering with CARMA365, cannabis businesses can benefit from our extensive experience and industry insights. We work closely with our clients to assess their individual needs and develop customized coverage plans that suit their specific requirements. With our support, you can confidently navigate the complexities of the insurance landscape, knowing that you have a dedicated advocate at your side committed to your success and protection.

Legal Considerations in Cannabis Insurance

Navigating the legal landscape of the cannabis industry is crucial for business owners seeking insurance coverage. The unique regulatory framework surrounding cannabis can vary significantly by state and even local jurisdictions. These variations create a layer of complexity when selecting insurance policies. Understanding the specific laws that apply to your operation is essential in securing the right coverage that will protect your business against legal risks.

Insurance providers often assess the legal status of cannabis in a given region when determining policy options and rates. The stigma associated with cannabis can also influence insurers’ willingness to underwrite these businesses. It is important for cannabis business owners to work with insurers who understand the nuances of the industry and can deliver tailored solutions that align with the legal environment in which they operate.

Additionally, keeping up with ongoing changes in legislation is vital. As laws evolve, so too should the insurance coverage you maintain. Regularly reviewing and updating your policy will help ensure that your business remains in compliance and protected against unforeseen legal challenges. Partnering with specialists in cannabis insurance can facilitate this process and provide peace of mind as you navigate the complexities of the industry.

The Importance of Choosing the Right Coverage

When it comes to insurance, selecting the right coverage is crucial, especially for businesses in the cannabis industry. The unique nature of cannabis operations presents specific risks that traditional insurance policies often overlook. This can lead to gaps in coverage that may leave your business vulnerable to unexpected challenges, such as property damage, liability issues, or regulatory compliance hurdles. Choosing coverage that is tailored to the cannabis sector ensures you are protected against these industry-specific risks.

Moreover, working with a specialized insurance provider like CARMA365© can simplify the process of navigating through the complexities of cannabis insurance. Their expertise allows them to understand the unique challenges those in the cannabis business face. They offer products designed specifically for this industry, so you can focus on growth and success rather than worrying about potential liabilities or financial setbacks.

Ultimately, the right coverage can provide peace of mind, giving you the confidence to operate your cannabis business effectively. Knowing that you have comprehensive, dependable insurance tailored to your needs allows you to concentrate on what matters most – your business’s success. With a suitable insurance plan in place, you can take calculated risks and pursue opportunities that could lead to growth, secure in the knowledge that you stand protected against unforeseen events.