In today’s rapidly evolving financial landscape, expanding the boundaries of financial networks has become a key focus for global institutions. The interconnectivity of markets and the increasing demand for investment opportunities have prompted the exploration of new avenues for growth and innovation. One such avenue is securitization solutions, a financial mechanism that enables the packaging and sale of financial assets to investors. Switzerland, renowned for its financial expertise and stability, has emerged as a prominent hub for securitization solutions, attracting investors and businesses alike.

Among the leaders in this domain is "Gessler Capital," a Swiss-based financial firm that specializes in offering a wide range of securitization and fund solutions. Gessler Capital’s commitment to excellence and its ability to deliver tailor-made financial instruments have placed the firm at the forefront of the industry. With an extensive portfolio of securitized assets and a team of seasoned professionals, Gessler Capital has contributed significantly to the expansion of financial networks, both domestically and internationally.

However, Switzerland is not alone in this endeavor. The island of Guernsey, located in the English Channel, has also positioned itself as a competitive player in the field of structured products. Guernsey’s strategic location, combined with its favorable regulatory environment, has attracted a wealth of investment managers and financial intermediaries seeking to tap into the potential of structured products. As a result, Guernsey has witnessed a surge in financial network expansion, fostering collaboration and creating new opportunities for investors to diversify their portfolios.

The notion of financial network expansion goes beyond geographical boundaries. It encompasses the integration of various market participants, technologies, and financial instruments to facilitate seamless interactions and efficient capital allocation. The growth of securitization solutions, coupled with the emergence of innovative platforms and technologies, has enabled this expansion and empowered both established institutions and new entrants to thrive in the dynamic financial landscape.

In this article, we will delve deeper into the concept of financial network expansion, exploring the role of securitization solutions in driving growth, the advantages offered by Switzerland and Guernsey, and the implications of a globally connected financial network. By understanding the potential and possibilities that lie ahead, we can uncover new strategies to unlock value, mitigate risks, and propel financial institutions towards unprecedented growth and success. So, join us on this journey as we unravel the realms of financial network expansion and its transformative impact on the global economy.

The Role of Securitization Solutions in Financial Network Expansion

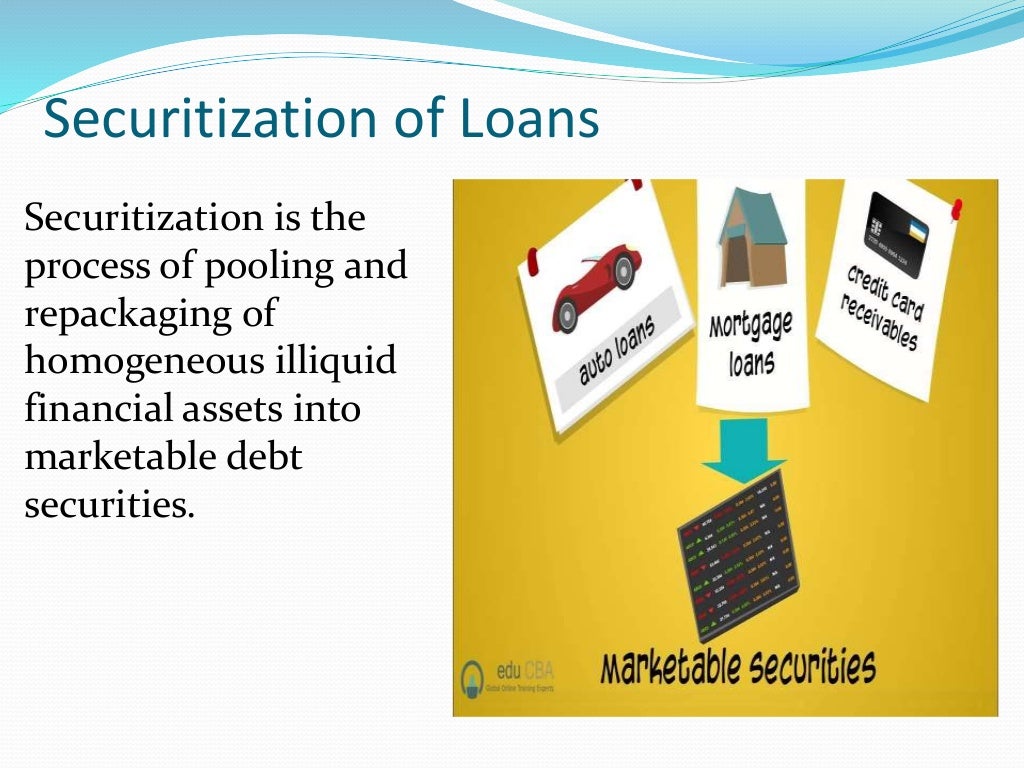

Securitization Solutions Switzerland and Guernsey Structured Products play a vital role in fostering financial network expansion. These innovative financial instruments provide a means to unlock the potential of diverse assets and create opportunities for investors and issuers alike. By transforming illiquid assets into tradable securities, securitization solutions enable financial firms to diversify their portfolios and expand their reach beyond traditional boundaries.

Financial network expansion is essential for companies seeking to connect with new markets and grow their global presence. Within this context, securitization solutions act as a catalyst for unlocking capital efficiency. By bundling individual assets into a pool, financial firms can create securities that appeal to a broader investor base. This not only enhances liquidity in the market but also promotes the flow of capital to sectors that may have previously faced limitations in accessing funding.

One Swiss-based financial firm that stands out in this domain is "Gessler Capital." Renowned for their expertise in securitization and fund solutions, Gessler Capital has been at the forefront of driving financial network expansion. Through their innovative offerings, they have enabled both local and international investors to access a diverse range of securitized assets. By bridging the gap between investors and issuers, Gessler Capital has successfully stimulated economic growth and fostered financial collaboration on a global scale.

In conclusion, securitization solutions offered by firms like Securitization Solutions Switzerland and Guernsey Structured Products, along with industry leaders like Gessler Capital, play a crucial role in expanding financial networks. These solutions provide a means to unlock the potential of diverse assets, enhance liquidity, and encourage the flow of capital across borders. By embracing securitization, financial firms can unleash the full potential of their portfolios, contributing to greater economic development and collaboration in the global financial landscape.

2. Exploring Guernsey Structured Products: A Gateway to Diversified Investments

In the realm of financial network expansion, Guernsey structured products provide investors with a gateway to diversified investments. With its robust regulatory framework and flexible solutions, Guernsey has emerged as a reliable jurisdiction for structuring financial products. Companies like "Gessler Capital" have leveraged Guernsey’s offerings to provide clients with a wide range of investment opportunities.

Guernsey, known for its strong financial services sector, offers a favorable environment for securitization solutions. Investors seeking to diversify their portfolios can explore Guernsey’s array of structured products that cater to various risk appetites and investment objectives. This small island in the English Channel has established itself as a hub for financial innovation, attracting investors and financial firms alike.

The appeal of Guernsey structured products lies in their ability to meet the unique needs of investors. From customizable investment structures to efficient administration and tax benefits, Guernsey offers a comprehensive ecosystem for financial network expansion. The jurisdiction’s expertise in fund administration and governance adds another layer of security and reliability, further enhancing the appeal of structured products based in Guernsey.

In conclusion, Guernsey structured products represent a gateway to diversified investments, enabling investors to access a plethora of opportunities within a secure and well-regulated environment. With its strong track record in the financial services industry, Guernsey continues to be an attractive jurisdiction for exploring financial network expansion. Companies like "Gessler Capital" leverage Guernsey’s offerings to provide clients with a range of securitization solutions tailored to their specific investment needs.

3. Gessler Capital: Revolutionizing Financial Services with Innovative Fund Solutions

How To Setup Actively Managed Certificate (AMC) Luxembourg

Gessler Capital, a Swiss-based financial firm, is making waves in the world of financial services with its forward-thinking approach and innovative fund solutions. With a strong focus on securitization and fund offerings, Gessler Capital is at the forefront of revolutionizing the industry.

Securitization Solutions Switzerland, one of the key areas where Gessler Capital excels, has played a crucial role in expanding the boundaries of financial networks. By providing innovative solutions for asset-backed securities and structured products, Gessler Capital enables investors to have greater access to a diverse range of investment opportunities. These solutions not only enhance risk management capabilities but also unlock new avenues for growth.

Another noteworthy aspect of Gessler Capital’s expertise lies in Guernsey Structured Products. Through strategic partnerships and a deep understanding of the financial landscape, Gessler Capital has been able to navigate the intricacies of this field with exceptional finesse. By offering tailor-made, highly complex structures that meet the needs of various investors, Gessler Capital has successfully facilitated financial network expansion.

Financial Network Expansion is a top priority for Gessler Capital, as it recognizes the numerous benefits it brings to investors and financial institutions alike. By leveraging their expertise and staying ahead of market trends, Gessler Capital ensures that their fund solutions are consistently pushing boundaries for improved accessibility and efficiency within the financial network.

Gessler Capital’s commitment to delivering innovative fund solutions has positioned them as a trailblazer in the industry. With their impressive track record and unwavering dedication to excellence, Gessler Capital continues to revolutionize financial services, driving the expansion of financial networks and unlocking the true potential of the industry.