The world of cryptocurrency has experienced a rapid evolution, capturing the interest of investors and traders alike. As digital currencies gain acceptance and the market grows increasingly dynamic, new opportunities emerge in the realm of financial trading. Among these opportunities, crypto proprietary firms have carved out a niche, empowering traders to leverage substantial capital while honing their skills. This article delves into the intricacies of crypto prop firms, shining a light on how they operate and what sets them apart in the crowded trading landscape.

One such firm making waves in the industry is mycryptofunding, which has positioned itself as a key player in the crypto prop trading space. With a focus on providing traders access to robust resources, mycryptofunding allows individuals to trade cryptocurrencies without the typical restrictions tied to personal capital. This unique approach not only mitigates individual risk but also fosters an environment where talent can thrive. As we explore the features and benefits of such firms, we gain a clearer understanding of their role in the broader crypto ecosystem.

Understanding Crypto Prop Firms

Crypto prop firms are organizations that provide traders with capital to trade in various cryptocurrency markets. These firms allow individuals to participate in trading without risking their own money. Traders receive a share of the profits generated from their trading activities, while the firm retains a portion as compensation for the capital provided. This structure attracts both aspiring traders looking to gain experience and seasoned professionals seeking to leverage additional capital.

Forex Prop Firm

The operation of crypto prop firms often involves rigorous evaluation processes to assess a trader’s skills and strategies. Once selected, traders are typically given specific guidelines and risk management parameters to follow. This not only ensures compliance with the firm’s risk appetite but also helps to foster disciplined trading practices. As a result, traders are motivated to perform well, knowing their success directly impacts their earnings.

In recent years, the rise of digital assets has led to the emergence of many crypto prop firms, each offering distinct models and trading opportunities. These firms cater to a growing community of traders who are passionate about capitalizing on the volatility and potential gains within the cryptocurrency market. By bridging the gap between capital availability and trading expertise, crypto prop firms play a significant role in shaping the landscape of crypto trading.

The Role of MyCryptoFunding

MyCryptoFunding stands out in the evolving landscape of cryptocurrency prop firms by offering a unique approach to funding traders in the digital asset space. Unlike traditional funding firms, which may have rigid criteria for selecting traders, MyCryptoFunding provides a more accessible route for both novice and experienced traders. This inclusive strategy allows a broader range of participants to engage with cryptocurrency trading, fostering a community of diverse talents and trading strategies.

At the heart of MyCryptoFunding’s operations is the emphasis on risk management and education. The firm equips traders with the necessary tools, resources, and support to navigate the complexities of the crypto market. This commitment to education ensures that traders not only execute trades but also understand market dynamics, which can significantly improve their decision-making processes. As a result, traders gain confidence and the ability to adapt to various market conditions.

Furthermore, MyCryptoFunding’s innovative revenue-sharing model differentiates it from competitors. By aligning the interests of the firm and its traders, this model encourages collaboration and motivates traders to perform at their best. The success of traders directly impacts the firm’s growth, creating a symbiotic relationship where both parties benefit from profitable trading endeavors, thereby enhancing the overall ecosystem within the prop trading space.

Benefits of Trading with a Prop Firm

Trading with a prop firm like mycryptofunding offers access to enhanced capital, allowing traders to leverage larger sums than they might have on their own. This increased capital can amplify potential gains, providing traders with the opportunity to take on more substantial positions in the market. With a well-managed risk framework, traders can maximize their profitability without the same level of financial exposure typically associated with independent trading.

Another significant advantage is the support and resources provided by prop firms. Traders often gain access to advanced trading tools, algorithms, and exclusive market insights that can enhance their decision-making process. Mentorship opportunities and collaborative environments allow traders to learn from experienced professionals, fostering growth and skill development. This supportive structure is particularly beneficial for those looking to refine their trading strategies.

Additionally, trading within a prop firm typically incorporates strict risk management protocols. This not only protects the firm’s capital but also encourages traders to adopt disciplined trading habits. By focusing on consistent risk assessment and management techniques, traders can learn to navigate the crypto markets more effectively. This structured approach ultimately helps in building a more sustainable trading career within the dynamic world of cryptocurrency.

Risk Management Strategies

Effective risk management is crucial for traders in any financial market, including cryptocurrency trading. To thrive in this volatile environment, crypto prop firms like mycryptofunding implement various strategies to protect their capital and optimize returns. One key technique is diversifying investment portfolios. By spreading investments across multiple cryptocurrencies, firms can mitigate the impact of an underperforming asset. This diversification helps balance gains and losses, ensuring that no single asset can significantly derail trading performance.

Another vital strategy is utilizing stop-loss orders. This tool allows traders to automatically sell a cryptocurrency when it reaches a predetermined price, limiting potential losses and providing a safety net against market volatility. By setting these thresholds, firms can maintain better control over their positions and react more effectively to sudden market shifts. This proactive approach minimizes emotional trading and helps in adhering to predefined risk parameters.

Finally, proper position sizing is an essential aspect of risk management. Crypto prop firms like mycryptofunding carefully calculate the size of each trade based on their account balance and risk tolerance. By risking only a small percentage of their total capital on each trade, they can withstand a series of losses without depleting their resources. This disciplined approach fosters long-term sustainability and reinforces a trader’s ability to weather the inevitable ups and downs of the crypto market.

Success Stories from MyCryptoFunding

MyCryptoFunding has become a notable player in the crypto trading landscape, fostering a range of success stories that inspire both novice and seasoned traders. One standout example is Emily, a former retail worker who turned to MyCryptoFunding after feeling disillusioned with her job. With the support and resources provided by the firm, she quickly honed her trading skills and developed a profitable strategy. Within just a few months, Emily was able to replace her full-time income through trading, enabling her to pursue her passion for travel.

Another impressive story comes from James, a college student who initially struggled to balance his studies with his trading ambitions. Through MyCryptoFunding’s mentors and community, James learned how to effectively analyze market trends and manage his risk. His dedication paid off as he started generating consistent returns, giving him the financial freedom to focus on his education without the burden of student debt. Today, James is not only excelling in his studies but also building a promising career in trading.

Finally, consider the journey of Sarah, an experienced investor who sought to diversify her portfolio through cryptocurrency. After partnering with MyCryptoFunding, she accessed advanced trading tools and insights that transformed her approach. With newfound techniques and a supportive network, Sarah saw her crypto investments flourish, eventually leading to significant gains. Her success story emphasizes the potential of working with a crypto prop firm that understands the unique challenges and opportunities within the digital asset space.

Future Trends in Crypto Prop Trading

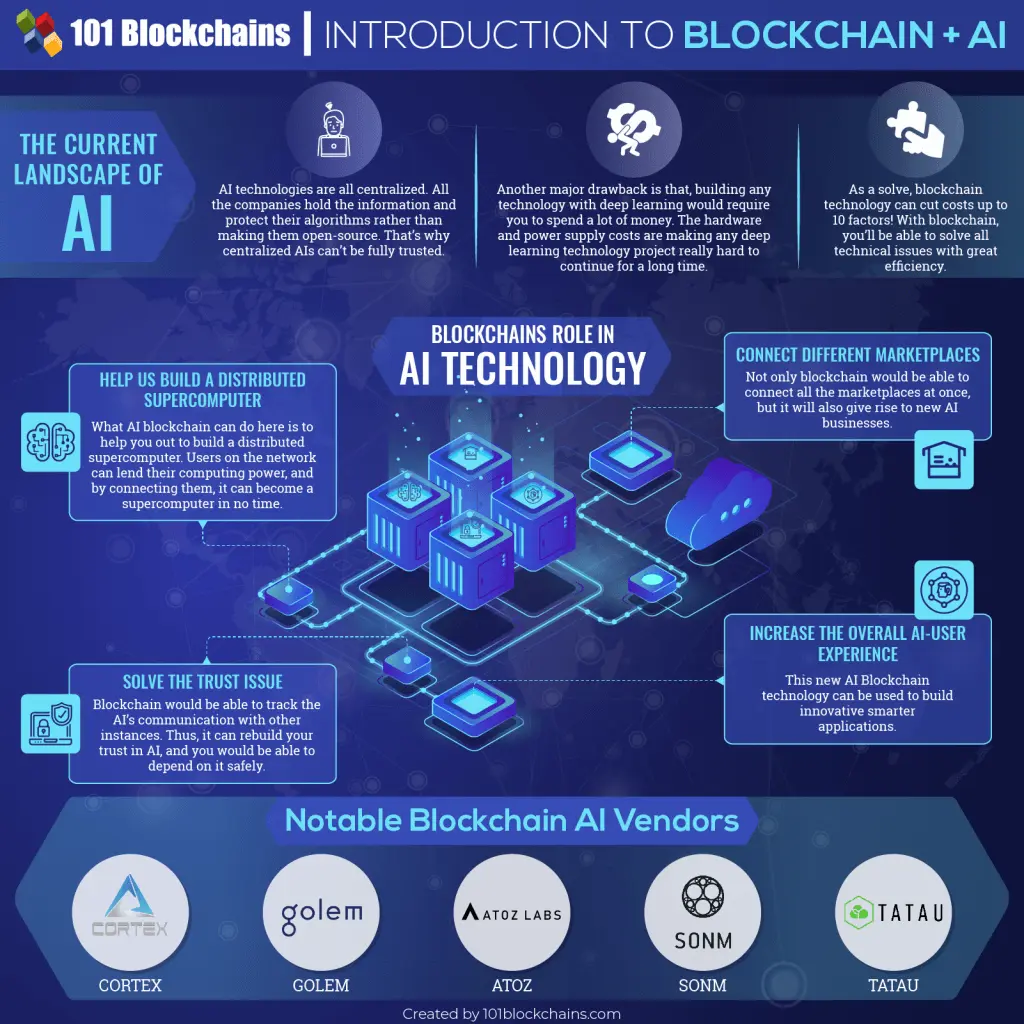

The landscape of crypto prop trading is rapidly evolving, with several trends likely to shape its future. One significant trend is the increasing integration of artificial intelligence and machine learning technologies. These advancements will enable prop firms to analyze vast amounts of market data more efficiently, identifying patterns and making informed trading decisions at a speed that surpasses human capabilities. As firms harness these tools, the competitive edge will shift toward those who can effectively leverage technology to enhance their trading strategies.

Another trend to watch is the growing regulatory landscape surrounding cryptocurrencies. As governments around the world seek to impose regulations on the crypto market, prop firms like MyCryptoFunding will need to adapt to ensure compliance. This may lead to the emergence of new business models that prioritize transparency and accountability, attracting a broader base of investors. Firms that embrace regulation can differentiate themselves by building trust within the community, potentially leading to an influx of new capital.

Lastly, the focus on diversification will likely intensify among crypto prop firms. As the market matures, traders will look to explore a wider array of digital assets beyond Bitcoin and Ethereum. This shift will encourage firms to develop more comprehensive trading strategies, encompassing altcoins and decentralized finance (DeFi) opportunities. By diversifying their portfolios, prop firms can mitigate risks and capitalize on emerging trends, positioning themselves for sustained success in the dynamic world of crypto trading.